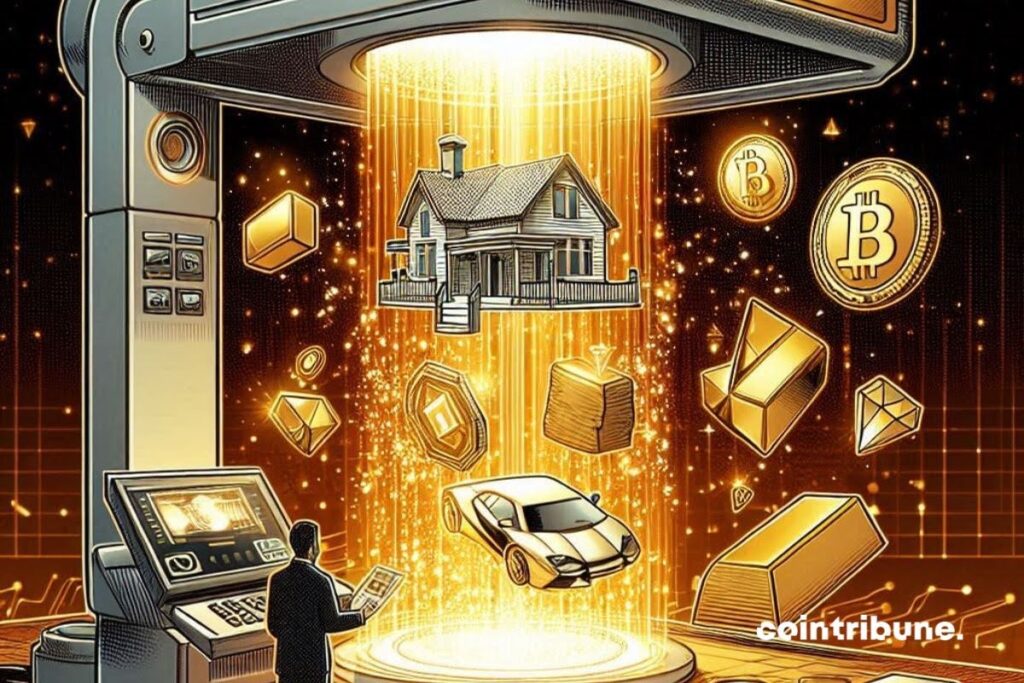

Blockchain -based finances are developing rapidly and offer innovative solutions to democratize access to investment and financing. The integration of the active world (RWA) remains a central problem among the challenges that are still present in this ecosystem. The aim of cooperation between Lumia and Credefi is to respond to these challenges by combining the infrastructure of layer 2 (L2) and experts on loans based on RWA.

RWA tokenization: lever for financial integration

Tokenization of traditional assets is one of the most promising areas of blockchain. By transforming physical assets into digital tokens, it allows to reduce entrance barriers, improve liquidity and facilitate access to markets. However, the implementation of this vision comes against several obstacles:

- Insufficient liquidity: Many projects seek to maintain the liquid market with tokenized RWA.

- Scalability: existing blockchains encounter problems with cost and transaction speed.

- Limited approach to complex financial tools: Diversification and risk management often remain out of the reach of individual investors.

In this context, Lumia and Credefi unify their strengths to offer integrated solutions and combine LMIA L2 infrastructure and credit services based on real Credefi assets.

Lumia and Credifi: Partnership to improve liquidity and availability

One of the key aspects of this cooperation is the benefit of the liquidity of Lumia to the ecosystem of Credifi. Better liquidity means more competitive interest rates, faster transactions and increased acceptance of loans based on RWA.

In addition, the introduction of synthetic active ingredients on Lumia L2 is the main progress. These tools inspired by traditional ETFs will enable investors to access the diversified baskets of tokenized assets, reducing the risk and preparing a way for more sophisticated financial strategies. In addition, LMIA L2 infrastructure offers a profitable, fast and scalable environment and will solve financial blockchain challenges such as high cost and network overload.

Therefore, with the launch of the planned at the first quarter of 2025, this partnership could mean an important step in integrating traditional finances and blockchain. This is because investment opportunities will be more accessible to a global audience.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The Cirtribnian editorial team connects its votes to express themselves on topics specific to cryptocurrencies, investments, metavers and NFT, trying to best answer your questions.

The provisions of unwavering:

The content and products listed on this page are in no case approved by Cointtribunian and should not be interpreted as responsibility.

Cointribune seeks to communicate all available information to the readers, but cannot guarantee its accuracy and exhaustion. We invite the reader to find out before any event concerning the company and also take full responsibility for their decision. This article cannot be considered as investment advice, offer or invitation to purchase all products or services.

Investments in digital financial assets include risks.

Read more